In the vibrant landscape of the banking sector, the term “quality control” holds vital importance. It surpasses ensuring error-free purchases; it incorporates a comprehensive technique to maintaining the integrity, integrity, and performance of financial operations.In this article, we will discuss Quality Assurance in the Banking Industry,Lets dive in

The Role of Quality Assurance in the Banking Industry

The Role of Quality Assurance in the Banking Industry

Ensuring Regulatory Compliance

Pursuing adherence to ever-evolving regulations is a keystone of quality control in banking. This ensures that the establishment runs within legal limits, reducing the danger of charges and legal repercussions.

Mitigating Risks

Quality control serves as a shield against possible risks that can endanger the monetary stability of a bank. Via rigorous threat analysis and management, financial institutions guard their assets and maintain a durable financial position.

Enhancing Customer Experience

Quality control extends to customer-centric methods, enhancing the general experience for customers. From smooth on-line purchases to customized solutions, financial institutions concentrate on producing favorable interactions that cultivate client commitment.

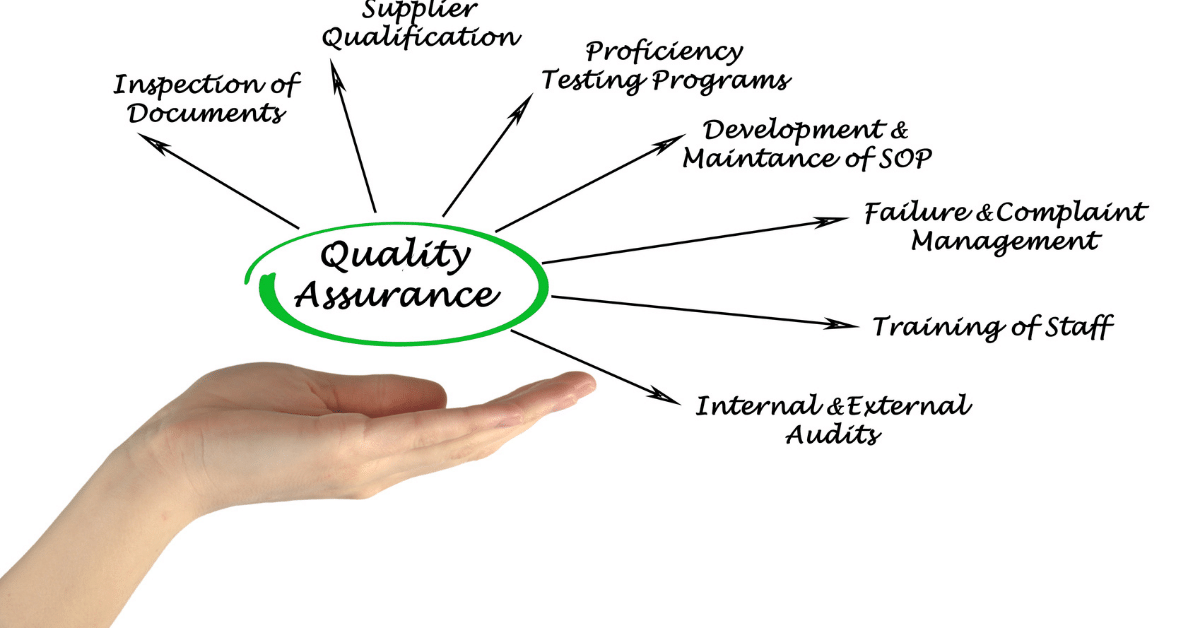

Trick Components of Quality Assurance

Trick Components of Quality Assurance

Robust Internal Processes

The foundation of quality control lies in well-defined inner processes. Banks establish and continuously fine-tune these procedures to get rid of bottlenecks, lower mistakes, and enhance effectiveness.

Regular Audits and Inspections

Regular audits and inspections are vital for reviewing the efficiency of inner controls. Quality assurance groups carry out thorough assessments, identifying areas of renovation and making sure conformity with industry criteria.

Employee Training and Development

Employees are the driving force behind quality assurance. Recurring training programs equip personnel with the current industry expertise, technological skills, and a dedication to upholding quality requirements.

Technical Advancements in Quality Assurance

Technical Advancements in Quality Assurance

Automated Testing

Automation streamlines testing procedures, allowing for faster and more accurate identification of potential concerns. Financial institutions leverage automated screening to boost the effectiveness of their systems while decreasing the margin for mistakes.

Artificial Intelligence and Machine Learning

AI and artificial intelligence contribute to predictive analytics, allowing banks to expect prospective challenges and proactively resolve them. These innovations change danger monitoring and decision-making procedures.

Blockchain Technology

The decentralized nature of blockchain boosts the safety and transparency of financial transactions. Its combination right into quality control structures minimizes fraud and guarantees the integrity of monetary data.

Challenges in Implementing Quality Assurance

Challenges in Implementing Quality Assurance

Resistance to Change

Implementing quality assurance may encounter resistance from employees accustomed to existing procedures. Efficient adjustment administration techniques are crucial to conquering this obstacle.

Balancing Efficiency and Stringency

Striking a balance in between operational efficiency and stringent quality assurance needs thoughtful planning. Quality assurance must improve procedures without restraining the speed of deals.

Adapting to Rapid Technological Changes

The fast evolution of innovation positions a challenge for banks to keep pace. Quality assurance has to be agile, adjusting to new technologies and ensuring their seamless assimilation.

Success Stories: Banks Implementing Effective Quality Assurance

Success Stories: Banks Implementing Effective Quality Assurance

Case Study 1: XYZ Bank

XYZ Bank’s aggressive strategy to quality control resulted in a substantial reduction in purchase errors, leading to enhanced consumer fulfillment and count on.

Case Study 2: ABC Bank

ABC Bank’s execution of innovative technologies in quality control not just improved functional effectiveness however additionally placed the bank as a market leader in technology.

Future Trends in Quality Assurance for Banks

Future Trends in Quality Assurance for Banks

Predictive Analytics

The future of quality assurance lies in predictive analytics, making it possible for banks to visualize potential issues and proactively resolve them before they impact operations.

Continuous Monitoring

Real-time surveillance of purchases and processes will come to be standard, allowing banks to identify and fix issues as they emerge, guaranteeing nonstop service.

Integration of Emerging Technologies

Quality assurance will remain to progress with the combination of emerging technologies, such as biometrics and quantum computer, additional fortifying the safety and dependability of banking procedures.

Value of Customer Feedback in Quality Assurance

Value of Customer Feedback in Quality Assurance

Listening to Customer Needs

Quality control reaches paying attention to client responses. Financial institutions that proactively look for and react to customer input can tailor their solutions to much better satisfy the advancing requirements of their clientele.

Implementing Customer-Centric Solutions

Quality assurance includes carrying out remedies that straighten with client assumptions. By understanding client choices, financial institutions can provide tailored and relevant services.

Building Trust Through Feedback

Depend on is the bedrock of the banking sector. Quality assurance initiatives centered around consumer feedback add to building and preserving the depend on of customers.

The Economic Impact of Quality Assurance

The Economic Impact of Quality Assurance

Strengthening Financial Stability

Quality control plays a pivotal function in preserving the monetary stability of banks, instilling self-confidence in investors and regulators.

Attracting Investors

Financial institutions with durable quality control techniques attract capitalists looking for institutions with a strong record of risk administration and operational quality.

Fostering Economic Growth

The collective effect of quality assurance in the banking market extends to promoting financial growth. Stable and trustworthy financial institutions add to a resistant and successful economic climate.

Conclusion

Conclusion

To conclude, quality assurance in the banking market is not simply a governing requirement but a tactical crucial. It safeguards the interests of stakeholders, improves customer experiences, and positions banks for sustained success in an ever-changing landscape.

FAQs

FAQs

What is the main goal of quality assurance in banking?

The main goal is to ensure conformity with guidelines, mitigate risks, and improve customer experiences.

Exactly how do financial institutions stabilize effectiveness and stringency in quality control?

Financial institutions strike an equilibrium through thoughtful planning, making sure quality assurance boost processes without impeding functional efficiency.

What role does consumer feedback play in quality assurance?

Client responses is important, leading banks to tailor their services, build depend on, and fulfill advancing consumer requirements.

Just how do emerging modern technologies influence the future of quality assurance in banking?

Emerging innovations, such as predictive analytics and continual monitoring, fortify the safety and integrity of banking operations.

Why is trust essential in the financial sector?

Trust fund is important as it underpins the connection between financial institutions, customers, and financiers, contributing to economic stability and development.