Welcome to the dynamic world of “Banking and Financial Support Services,” where the convergence of cutting-edge technology and customer-centric options is reshaping the way financial institutions run. In this article, we will certainly look into vital trends transforming client service, explore the pivotal duty of innovation in riches management and core financial, and unwind the intricacies of the monetary solutions field. Join us as we browse via the importance of structure robust consumer partnerships, the ever-evolving landscape of monetary guidance, and the duty of electronic financing in this busy sector. Let’s embark on a trip to untangle the intricacies and technologies that specify modern banking and financial backing services.

Banking and financial services

Financial and Financial Services in Evolution

The financial and monetary solutions market is experiencing an extensive development, driven by a convergence of modern technology and an increased concentrate on client complete satisfaction. Generally regarded as a stiff sector, recent fads are improving its landscape, pressing institutions to adapt to changing client assumptions and arising technologies.

Trick Trends Shaping Customer Service

When faced with this advancement, the short article starts by analyzing 3 key patterns transforming client service within the banking and economic solutions market. From the adoption of cutting-edge innovations to the vital of being customer-friendly at scale, these trends underscore the industry’s commitment to remaining ahead in a competitive and vibrant environment.

Navigating the Financial Services Sector

Our expedition prolongs past customer service, diving right into the wider monetary solutions industry. Comprehending the value and elements of this market is vital for any person crazy about realizing the intricate internet of services that contribute to financial security and development. We’ll decipher the relevance of monetary supervision, the dynamics of customer finance, and the duty of auditors in preserving transparency.

Investing in Customer Relationships

Identifying the critical role of client relationships, the write-up highlights the demand for banks to buy building robust links with their clients. From self-service alternatives to maximizing for efficiency and using data-driven insights, the modern technique to banking is geared in the direction of providing a smooth and secure experience, as affirmed by top-rated customer service systems trusted internationally.

Future-Ready Banking and Wealth Management

The change does not end there; we’ll also check out the essential role of modern technology in wealth management, core banking, and customer portal improvement. As we review future-ready financial services, the focus will certainly be on staying abreast of developments to offer not just reliable however likewise customized and safe and secure financial services.

As we start this journey through the details of financial and financial support solutions, this section lays the foundation for a thorough exploration. Join us in untangling the multifaceted facets of the monetary services industry, where development and customer-centric strategies drive the sector onward. The following areas will dive deeper right into each aspect, supplying beneficial understandings right into the ever-evolving globe of modern financial.

Customer-Centric Solutions

Customer-Centric Solutions

Purchasing Customer Relationships

In an age where client experience reigns supreme, financial institutions are acknowledging the need to spend considerably in structure and nurturing client relationships. The area starts by highlighting the essential role of customer complete satisfaction and loyalty in the success of banking and economic solutions. Organizations are increasingly embracing methods to be not simply service providers yet trustworthy partners in their clients’ economic journeys.

Be Customer-Friendly at Scale

The write-up continues to look into the important of being customer-friendly at scale. As the consumer base grows, so does the obstacle of preserving tailored communications. This area discovers how organizations are leveraging modern technology and cutting-edge techniques to guarantee a seamless and customer-centric experience, also as they deal with a more comprehensive audience.

Profit from Self-Service

A significant shift in customer service dynamics comes with the capitalization on self-service choices. Modern customers seek autonomy in managing their funds, and establishments are reacting by supplying intuitive self-service platforms. This part of the area checks out the different self-service options carried out by banking and financial institutions, equipping customers while enhancing functional performance.

Optimize for Speed and Efficiency

Efficiency is extremely important in the busy world of financial. Here, we discover exactly how organizations are enhancing their processes for speed and efficiency. From streamlined onboarding processes to expedited transaction processing, the focus gets on giving fast and reliable solutions that straighten with the assumptions of today’s digitally empowered consumers.

Let Data Lead the Way

Data-driven understandings play an important function in recognizing client actions and preferences. This section checks out exactly how financial institutions are leveraging information analytics to obtain workable understandings. By comprehending consumer requirements and choices, establishments can customize their services, developing a much more tailored and targeted technique that promotes more powerful consumer partnerships.

Keep Safe with State of the Art Security

In an era of boosted cyber dangers, safety is non-negotiable. This part of the area highlights the relevance of durable safety and security steps in monetary solutions. It discovers just how organizations are staying ahead of potential threats by applying cutting edge protection methods. Trust fund and confidence in the safety of financial purchases are essential components in preserving strong customer connections.

Top Rated Customer Service Platform

The short article includes insights right into premier customer service platforms, relied on by a global customer base. By understanding the features and success stories of these systems, visitors gain a detailed sight of the devices that enable institutions to offer excellent client service. Real-world instances show the effect of executing such systems on client complete satisfaction and commitment.

Allow’s Keep It Simple: We Want to Be Your Friend

The area wraps up by stressing the simplicity of the overarching objective: to be a reliable close friend to consumers. In the midst of technological innovations and innovative solutions, the human touch remains crucial. Banks intend not just to offer however to develop long-lasting partnerships, simplifying complicated economic processes to be a trusted ally in their customers’ monetary trips.

As we conclude this area, it is evident that customer-centric services go to the center of modern-day banking practices. The following areas will further discover details facets of modern technology and solutions that contribute to a seamless and customer-friendly economic experience.

Join us as we uncover the subtleties of premier customer service systems and explore the transformative power of technology fit the future of banking.

Client Service Platform

Client Service Platform

Top Rated Customer Service Platform

This section focuses on the relevance of taking on a top-rated client service system for financial and banks. By exploring the features and success tales of these systems, visitors acquire valuable insights right into the devices that raise client service to brand-new elevations. These platforms, relied on around the world, work as the backbone for delivering smooth and responsive customer experiences.

Trusted by Over 60,000+ Customers Worldwide

Highlighting the widespread trust in these platforms, this part of the section emphasizes the global reach and approval of top-rated customer service options. The sheer variety of completely satisfied consumers worldwide highlights the efficiency and reliability of these systems, making an engaging case for their fostering by banking and economic company.

Allow’s Keep It Simple: We Want to Be Your Friend

The human touch is a recurring motif in this area, stressing that, despite innovative technical options, the ultimate goal is to establish a pleasant and reliable relationship with customers. These systems are not just devices; they are friends in the economic trip, simplifying complexities and giving assistance that exceeds transactional communications.

Find out more About Freshdesk

As an illustrative example, this part of the area looks into the specifics of Freshdesk, a top-rated customer care system. By giving in-depth insights into the features and capabilities of Freshdesk, readers gain a concrete understanding of exactly how such systems boost client service in the financial and monetary domain. Exploring particular functionalities offers a functional perspective on the devices offered for organizations to attain client service quality.

Finally, the customer support platform is the cornerstone in the modern-day banking and financial solutions environment. By investing in premier platforms like Freshdesk, establishments not just simplify their operations however likewise raise the customer experience.

The worldwide count on these systems and the focus on simpleness and human link underscore their relevance in cultivating long-term connections with customers. The adhering to areas will even more check out the broader technological landscape and its influence on various elements of banking and financial backing solutions. Join us as we navigate via the intricate details of mobile applications, solutions, and the ever-evolving world of monetary innovation.

Wealth Management and Core Services

Wealth Management and Core Services

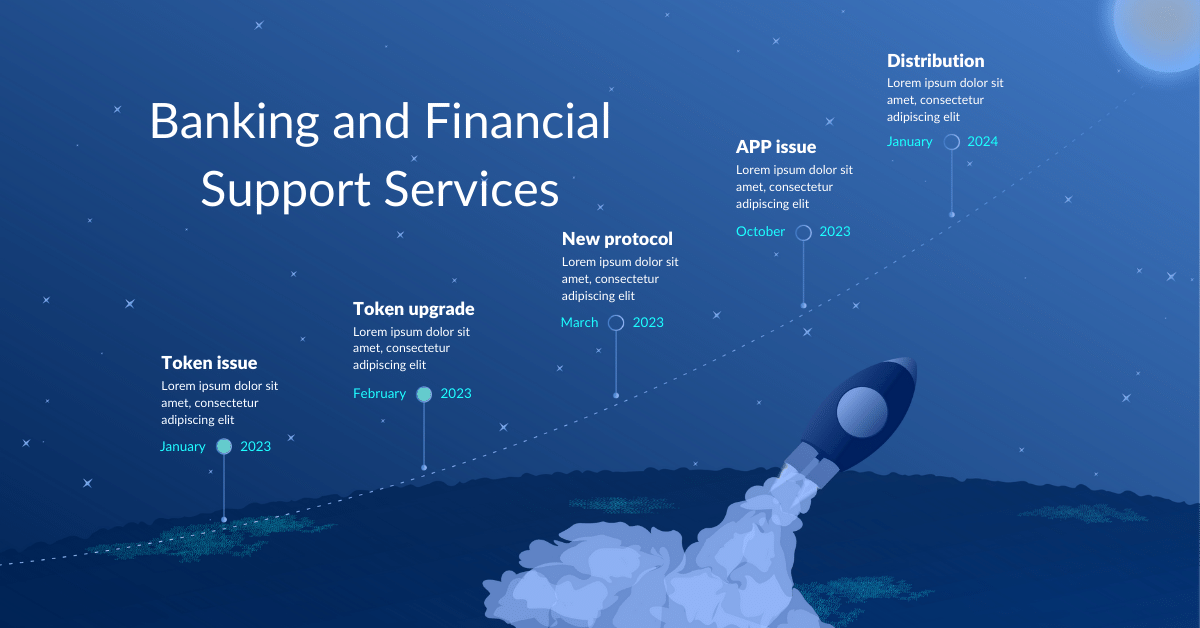

Future-Ready Banking Solutions

The section opens by discovering the concept of future-ready financial services, where technical innovations play an essential role in improving wealth management and core financial services. The economic landscape is progressing, and organizations need to accept advancement to remain competitive. We explore the crucial trends and technologies that specify the future of financial, guaranteeing it continues to be adaptive and responsive to transforming market dynamics.

Powering Future-Ready Banking

Continuing the discussion on future-ready banking, this part of the section explores the technologies powering this change. From artificial intelligence and machine learning to blockchain and information analytics, these innovations are revolutionizing the method banks take care of wide range administration and core banking services. Recognizing these technical enablers is essential for organizations desiring stay at the center of the sector.

A Complete User Portal Transformation

User websites serve as the portal for clients to communicate with financial solutions. This section checks out the relevance of a total customer site makeover, where the focus gets on enhancing the individual experience. From intuitive user interfaces to tailored control panels, organizations are buying developing portals that not just provide information but also empower users to manage their finances with ease.

Customer Experience in Wealth Management

As wealth administration thinks a main duty in financial solutions, the section moves to a detailed exploration of customer experience in this domain. From personalized investment strategies to real-time profile tracking, the emphasis gets on giving a seamless and user-centric experience. Establishments are leveraging technology to tailor riches management services, ensuring they straighten with specific monetary objectives and choices.

To conclude, the area underscores the transformative impact of modern technology on wide range administration and core financial services. Future-ready financial is not just a vision but a need for establishments aiming to prosper in a swiftly progressing financial landscape.

From ingenious innovations shaping the future to a focus on individual portal makeover and personalized customer experiences, the trip through this area provides a thorough understanding of the characteristics specifying the contemporary period of financial. Join us as we dig deeper into the governing framework, the more comprehensive financial services sector, and the function of modern technology in shaping the financial landscape.

Financial Services Sector Overview

Financial Services Sector Overview

Significance and Components of the Financial Services Sector

This area launches an extensive expedition of the economic services industry, shedding light on its overarching importance and the elaborate parts that collectively drive economic stability and growth. Comprehending the relevance of this market is critical for browsing the complexities that specify the modern-day financial landscape.

What Is the Financial Services Sector?

Delving much deeper, we take a look at the essential question of what makes up the monetary solutions field. From traditional financial services to a spectrum of monetary products and offerings, this part of the section provides a nuanced understanding of the diverse aspects that fall under the umbrella of financial solutions.

The Importance of the Financial Services Sector

Highlighting the important role played by the financial solutions industry in worldwide economic climates, this sector emphasizes its effect on funding allocation, risk monitoring, and financial growth. By assisting in the circulation of funds and providing important solutions, the market works as a foundation for lasting economic growth.

Banking Services

Zooming into details elements, we check out financial services within the monetary industry. From core financial operates to specialized sectors, this part of the section uses insights into the varied variety of services that banks supply, guaranteeing a foundational understanding of their function in the wider economic ecological community.

Investment Services

This subsection moves the emphasis to financial investment services, clarifying the different methods which banks sustain financial investment tasks. Whether via property management, investment financial, or various other services, establishments play a critical function in assisting in investment choices and funding market tasks.

Insurance Services

Insurance policy is a crucial component of the economic solutions sector, mitigating risk and giving financial protection. This part of the area discovers the diverse landscape of insurance policy solutions, from life and health insurance to property and casualty coverage, highlighting their essential duty in protecting individuals and businesses.

Tax Obligation and Accounting Services

Browsing the economic landscape entails adherence to governing demands and sound accounting practices. This subsection sheds light on the role of tax obligation and accounting services within the financial solutions industry, stressing their payment to openness, compliance, and financial stewardship.

What Is in the Financial Services Sector?

Addressing the inquiry of what drops under the purview of the financial services sector, this sector supplies a detailed introduction. From banking and financial investment to insurance policy and accountancy, the varied array of services collectively contributes to the sector’s diverse function in supporting financial activities.

In conclusion, this area offers a foundational understanding of the economic solutions sector. By discovering its significance, elements, and details solutions, visitors acquire understandings into the elaborate internet of tasks that define this dynamic sector.

The succeeding sections will even more explore regulative frameworks, plans, and the duty of modern technology in shaping the future of banking and financial services. Join us as we decipher the complexities and nuances of this ever-evolving landscape.

Regulative Framework

Regulative Framework

Financial Supervision and Risk Management

This area navigates with the important facets of financial supervision and risk monitoring within the banking and economic solutions field. Governing frameworks play an essential duty in guaranteeing the stability and honesty of economic systems. We discover how organizations are subject to supervision to keep conformity, manage threats efficiently, and maintain the trust of stakeholders.

Customer Finance and Payments

Zooming right into the governing landscape, we look into the realm of consumer financing and settlements. Governing frameworks in this domain are created to secure consumer interests, guarantee fair practices, and promote openness. By discovering the plans regulating consumer money and payments, visitors gain understandings into the measures implemented to safeguard financial consumers.

Financial Markets

The area extends its focus to the regulatory oversight of monetary markets. Regulatory bodies play a crucial role in preserving the justness, performance, and transparency of monetary markets. We discover the devices in place to prevent market abuse, make sure appropriate disclosure, and promote an equal opportunity for participants.

Insurance Policy and Pension Funds

Policy in the insurance policy and pension plan fund fields is paramount for making sure the lasting monetary health of people. This part of the section browses through the regulatory frameworks governing insurance policy and pension plan funds, highlighting their role in shielding insurance holders and pension contributors.

Bookkeeping of Companies’ Financial Statements

Transparency and accountability are keystones of a durable economic system. This subsection checks out the governing needs for bookkeeping firms’ economic declarations. By ensuring accurate and trustworthy financial reporting, these regulations contribute to building depend on among capitalists, creditors, and other stakeholders.

Sustainable Finance

In an era where sustainability is a global concern, this part of the area delves into the regulative landscape of sustainable financing. Governments and regulatory bodies are progressively recognizing the importance of incorporating ecological, social, and administration (ESG) elements into monetary decision-making. We check out the plans and initiatives focused on advertising sustainability within the monetary field.

Digital Finance

The regulatory landscape is developing together with technological innovations in electronic financing. From fintech technologies to digital payment systems, this subsection checks out just how regulatory authorities are adapting to ensure the security and stability of electronic economic solutions. We unwind the plans that strike an equilibrium between cultivating innovation and mitigating potential risks.

EU Sanctions (Restrictive Measures).

Offered the global nature of economic deals, international collaboration is vital. This part of the section focuses on EU permissions and limiting treatments, highlighting the feature of such procedures in addressing financial risks, marketing tranquility, and attending to problems linked to worldwide security and protection.

Anti-Money Laundering and Responding To the Funding of Terrorism.

In the battle versus financial criminal tasks, plans settling anti-money laundering (AML) and responding to the financing of terrorism (CFT) are essential.. This subsection checks out the governing structures in place to identify and stop illegal economic activities, highlighting the duty of organizations in maintaining the stability of the financial system.

Reform Support for the Financial Sector.

The area ends by attending to the wider theme of reform assistance for the monetary sector. Federal governments and regulatory bodies frequently set up reforms to resolve emerging challenges, enhance the strength of financial institutions, and adjust to developing worldwide economic characteristics. We explore the nature and effect of reform initiatives focused on fostering a healthy and balanced and sustainable financial market.

In conclusion, this section gives a thorough expedition of the regulatory framework shaping the banking and monetary services field. By understanding the policies controling monetary guidance, customer financing, markets, insurance coverage, and much more, visitors get insights into the devices that underpin the stability and stability of the financial system.

The succeeding areas will better unwind the ins and outs of banking solutions, policies, and the function of technology in shaping the future of financial solutions. Join us as we browse through the dynamic and controlled landscape of contemporary financial.

Innovation in Banking.

Innovation in Banking.

Software program Solutions.

As modern technology continues to reshape the banking landscape, this section looks into the function of software program solutions in enhancing procedures and improving client experiences. From core banking systems to ingenious fintech applications, establishments are leveraging software to improve processes, offer innovative solutions, and stay competitive in a rapidly developing market.

Customer Care Suite.

A crucial component of technology in banking is the customer support collection. This subsection checks out just how institutions are taking on detailed customer care systems to give reliable and customized support. The emphasis gets on producing smooth consumer experiences, resolving queries promptly, and building lasting partnerships via technology-driven service quality.

Mobile Apps for Banking.

In the age of digital change, mobile apps have ended up being crucial devices for both consumers and financial institutions. This part of the section navigates through the landscape of mobile apps in financial, emphasizing their role in supplying on-the-go access to economic solutions, enhancing ease, and promoting a digital-first strategy.

Solutions for Future-Ready Banking.

As institutions strive to end up being future-ready, this subsection discovers the diverse array of services available. From advanced analytics and artificial intelligence to blockchain and cybersecurity procedures, establishments are buying technologies that not just resolve present challenges however also place them for success in the developing financial landscape.

Top Features in Banking Solutions.

Highlighting the crucial functions that define modern-day banking remedies, this part of the section provides a detailed expedition. From straightforward interfaces to durable protection steps and real-time analytics, establishments are focusing on attributes that deal with the advancing needs of customers while ensuring the stability and safety and security of financial deals.

Mobile Apps for Banking.

With an increasing reliance on mobile devices, this subsection takes a closer look at the significance of mobile applications in the financial market. From account management to money transfers, mobile applications offer a hassle-free and user-friendly way for customers to involve with financial services. The area discovers the functions and functionalities that make mobile apps an important element of the modern-day financial experience.

To conclude, this section supplies a thorough introduction of the duty of innovation in shaping the banking landscape. From software program solutions and customer care platforms to mobile applications and future-ready banking services, institutions are leveraging modern technology to enhance efficiency, offer cutting-edge services, and stay ahead in an affordable environment.

The succeeding areas will better explore specific facets of financial services, plans, and the wider financial solutions industry. Join us as we unravel the intricacies and developments that specify the crossway of technology and financial.

Essential.

Essential.

Browsing the Dynamic Landscape.

In this extensive expedition of “Banking and Financial Support Services,” we’ve travelled with the vibrant landscape where technology, customer-centric services, governing frameworks, and ingenious methods assemble to form the modern economic environment. As we wrap up, allow’s review the crucial insights garnered from our exploration.

The Evolution of Customer-Centric Solutions.

Consumer connections have emerged as a prime focus for success in banking and financial solutions. Organizations are not simply transactional entities; they are building meaningful connections with consumers. The financial investment in being customer-friendly at range, profiting from self-service, enhancing for effectiveness, and allowing data blaze a trail highlights a shift towards an extra individualized and responsive method.

The Crucial Role of Technology.

Innovation attracts attention as a transformative pressure, influencing every aspect of financial. From sophisticated software options to top-rated customer service systems and mobile applications, organizations are utilizing modern technology to boost operational effectiveness, provide smooth client experiences, and stay abreast of industry fads.

Future-Ready Banking and Wealth Management.

Our exploration into future-ready banking remedies and wealth monitoring highlights the importance of remaining flexible in a swiftly advancing financial landscape. Technical enablers such as AI, machine learning, and data analytics are not just buzzwords; they are essential to forming the future of banking services, guaranteeing they are not just efficient however additionally customized and responsive to individual demands.

The Regulatory Framework: Safeguarding Integrity.

Governing structures play an essential function in ensuring the stability and integrity of the economic system. From economic guidance and risk management to customer money, auditing, and combating monetary criminal activities, regulations are designed to guard the passions of consumers, financiers, and the wider economy.

The Intersection of Sustainability and Finance.

The expedition of lasting financing emphasizes a growing recognition of the demand to align monetary experiment environmental, social, and governance factors to consider. As the monetary industry develops, sustainability ends up being a directing principle, shaping financial investment choices and contributing to a more liable and moral financial environment.

The Human Touch in Banking.

Among technological improvements and governing complexities, the human touch remains an essential facet of banking. Establishments aspire not just to give solutions yet to be relied on close friends on their clients’ monetary journeys. This emphasis on simplicity, openness, and real links reinforces the enduring worth of human connections in financial.

Looking Ahead: A Future of Innovation and Collaboration.

As we end this expedition, we cast a stare right into the future of financial and financial backing solutions. The trajectory factors towards continued advancement, collaboration, and adaptability. The combination of arising innovations, the quest of lasting practices, and a commitment to customer-centricity will certainly specify the success of organizations in the years to come.

Join Us in the Continued Exploration.

This article works as a photo of the complex and ever-evolving landscape of banking and monetary solutions. Our journey does not end here; it’s an invitation to proceed discovering the subtleties, innovations, and difficulties that specify this dynamic sector. Whether you’re an expert in the field, an aspiring enthusiast, or merely curious concerning the future of financing, the expedition proceeds. Join us in uncovering the following phase of financial and financial backing services.

Verdict.

Verdict.

In conclusion, the article “Banking and Financial Support Services” supplies a holistic expedition of the diverse landscape where modern technology, customer-centricity, governing frameworks, and sustainability merge to define the modern-day financial ecological community. From the evolution of customer-centric services to the essential duty of modern technology fit financial methods, and from browsing regulative intricacies to welcoming sustainable money, the trip has actually been one of unraveling complexities and welcoming technology.

As we browse the dynamic landscape of future-ready financial, the human touch remains integral, enhancing the long-lasting value of significant connections in the monetary realm. Looking ahead, the write-up invites readers to continue discovering the ever-evolving globe of banking, where advancement and collaboration pave the way for a future identified by adaptability, sustainability, and customer-centric quality.