In the landscape of financial and money, APY (Annual Percentage Yield) in banking stands as an essential metric defining real potential of your savings or investment accounts. It’s vital to grasp the concept and relevance of APY, as it directly affects the development of your funds gradually.

What is APY?

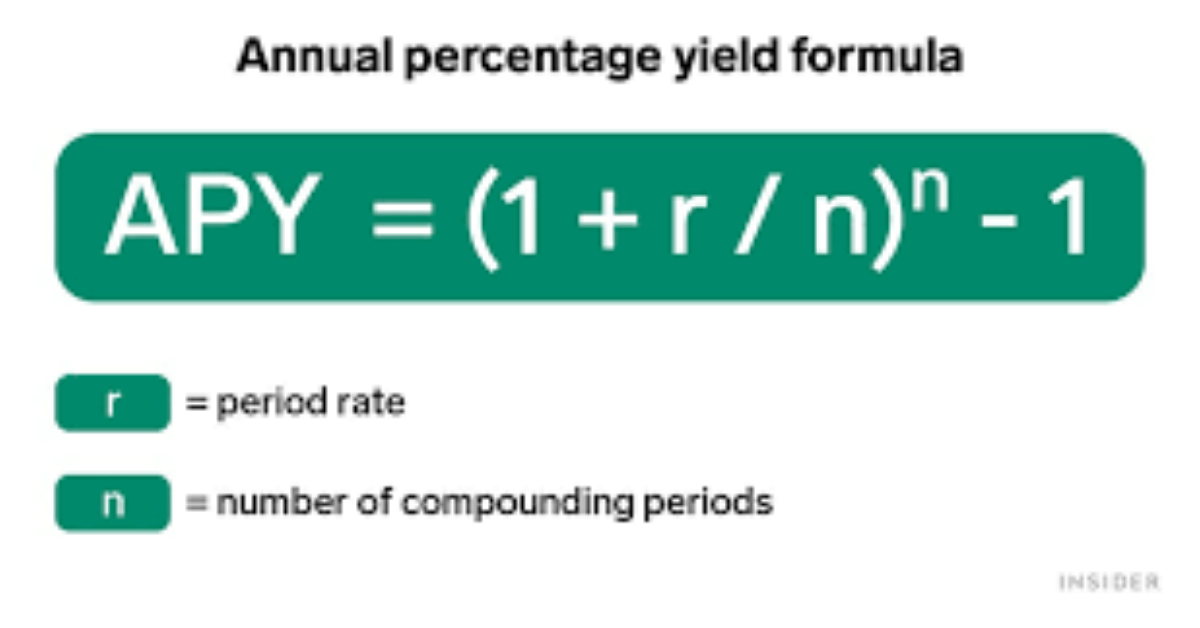

APY, usually perplexed with APR (Annual Percentage Rate), stands for the overall quantity of interest you earn on an account over a year, including compound rate of interest. Unlike APR, which consider just the rate of interest without taking into consideration worsening, APY shows the actual return consisting of compounding results.

Exactly How APY Works

Recognizing the working device of APY is basic to making informed financial decisions. It takes into consideration the frequency of worsening and the first principal to compute the built up rate of interest gradually.

The Compounding Effect

The magic of APY lies in compounding, where your interest makes interest. As an example, if your interest-bearing accountsubstances quarterly, the interest adds to the primary every three months, enabling your balance to grow at an accelerated price.

Elements Affecting APY

Several elements contribute in figuring out the APY of an account, and recognizing these variables encourages you to make critical options.

Rates of interest

The rates of interest directly impacts the APY. A greater rates of interest implies greater revenues, while a lower rate might hinder the growth of your funds.

Intensifying Frequency

The frequency at which passion is worsened significantly influences the APY. The more frequent the compounding, the greater the yield because of the added rate of interest.

Account Balance and Terms

Different account types and terms impact APY. Some accounts might use greater APYs for larger equilibrium’s or longer terms, while others cater to shorter-term investments.

Maximizing APY for Financial Growth

To utilize APY effectively for economic development, take into consideration the following techniques:

Contrast and Choose Wisely

Research different financial institutions and financial institutions to locate the very best APY used on financial savings or financial investment accounts. Comparing choices can bring about discovering higher-yield possibilities.

Go With Compounded Interest

Select accounts that substance rate of interest often, such as daily or monthly, as it can significantly improve your APY.

Routine Contributions

Continually including funds to your account contributes to a larger principal amount, causing greater rate of interest profits with time.

Value of APY in Banking Planning

Incorporating APY factors to consider right into your monetary preparation is vital for lasting wealth build-up. Whether it’s for savings accounts, CDs, or financial investment portfolios, understanding and taking full advantage of APY boosts your financial position.

Goal-Oriented Savings

Setting economic goals aligned with greater APYs can encourage self-displined saving practices and ensure better returns on your financial investments.

Retired life Planning

For retired life cost savings, concentrating on accounts with competitive APYs can significantly affect the overall funds collected by the time of retirement.

Verdict

Recognizing the nuances of APY equips people to make educated monetary choices. It’s not just a number; it’s the gateway to optimizing profits on your savings and investments.

By comprehending the factors that influence APY and utilizing calculated approaches, individuals can secure a far better economic future.